They met the way most relationships do today.

Same space. Same routine. Same late conversations.

It felt like love.

Maybe it was.

Marriage followed. A family. A child. Photographs that looked complete.

Then reality stepped in.

Love turned into responsibility. Conversations into expectations. Care into calculation. What once felt like destiny slowly became dependence.

Arguments stopped being about issues and started being about blame.

Who sacrificed more. Who suffered more. Who deserved more.

Separation came easier than repair.

Reputation was questioned. Trust was broken. A child was caught in between. Lawyers became part of the family narrative. What began as affection ended as paperwork.

Years later, both moved on. New partners. New beginnings. New smiles. Society moved on too.

But the question stayed.

Was it love…

or was it requirement mistaken for destiny?

Two decades ago, films told us “they are made for each other.”

Reality tells a different story. Even public love stories ended. Today, thousands of ordinary lives repeat the same pattern quietly.

Love does exist.

But love alone is not enough.

Love without maturity becomes dependency.

Love without responsibility becomes entitlement.

Love without patience becomes revenge.

Most people fall in love.

Very few learn how to stay.

Maybe the real lesson is this:

Before asking who is meant for me, we should ask am I ready for what love demands?

#Love #Relationships #Marriage #Divorce #EmotionalMaturity #ModernLife

-

-

A STUDY OF HUMAN INNER CONFLICT, BELIEF, AND RATIONALITY

Author: Sidheswar Jena

Designation: Ph.D. Scholar (Law)

Institution: Vivekananda Global University, Jaipur, Rajasthan, India

ABSTRACT

Human behaviour often reflects an internal conflict between rational understanding and emotional impulses, scientific reasoning and spiritual belief, and moral awareness and actual conduct. This paper examines whether such contradictions indicate psychological instability or represent a natural condition of human existence. Using an interdisciplinary approach drawing from philosophy, psychology, neuroscience, and legal theory, the study explores why individuals simultaneously accept scientific explanations and spiritual beliefs, acknowledge impermanence yet pursue material accumulation, and recognise moral wrongs while failing to act consistently. The paper argues that such inner conflict is intrinsic to human cognition and does not negate moral or legal responsibility. Instead, understanding this duality provides a more realistic foundation for legal accountability and normative frameworks.

Keywords: Human cognition, belief systems, moral conflict, rationality, legal responsibility

1. INTRODUCTION

Human life is marked by contradiction. Individuals frequently experience conflict between what they know to be true and how they act, between belief and doubt, and between moral standards and personal desires. The question “Is everything alright with me?” is not merely introspective but raises broader philosophical and legal concerns regarding human rationality and responsibility.

Despite scientific advancement and increased access to knowledge, human conduct continues to reflect inconsistency. People acknowledge the impermanence of life and the certainty of death, yet actively pursue wealth, property, and social status. Similarly, individuals recognise moral wrongs such as greed, jealousy, and unethical behaviour, yet often struggle to avoid them. This paper seeks to analyse whether such contradictions are individual failures or inherent aspects of human nature.

2. CONCEPT OF HUMAN DUALITY: REASON AND BELIEF

Philosophical discourse has long recognised the divided nature of human consciousness. Plato conceptualised the human soul as consisting of rational, spirited, and appetitive elements, often in conflict with one another (Republic). This philosophical insight remains relevant in modern cognitive science.

Contemporary psychological theories, particularly Daniel Kahneman’s dual-process model, explain human cognition through two interacting systems: intuitive and emotional thinking, and slow, analytical reasoning (Kahneman, 2011). This framework explains why individuals may intellectually accept scientific theories such as evolution while emotionally or spiritually identifying as creations of God. Such coexistence of belief systems does not indicate irrationality but reflects the layered structure of human cognition.

3. KNOWLEDGE VERSUS ACTION: THE PROBLEM OF INCONSISTENCY

The disconnect between knowing what is right and acting accordingly has been examined since classical philosophy. Aristotle referred to this condition as akrasia, where individuals act against their better judgment (Nicomachean Ethics). Modern psychology supports this observation through the theory of cognitive dissonance, which explains how individuals maintain contradictory beliefs and behaviours simultaneously (Festinger, 1957).

This explains why awareness of moral standards does not guarantee moral conduct. Emotional impulses, social pressures, fear, and personal insecurity often override rational judgment. Therefore, inconsistency in behaviour is not an exception but a recurring feature of human decision-making.

4. IMPERMANENCE AND MATERIAL PURSUIT

Philosophical traditions such as Buddhism emphasise impermanence (anicca), a concept increasingly supported by existential philosophy and neuroscience. Despite this awareness, humans continue to accumulate wealth and property in search of stability.

Psychological theories such as Terror Management Theory explain this behaviour as a response to mortality awareness. According to this theory, individuals pursue material success and social validation as a coping mechanism against the anxiety generated by the awareness of death (Greenberg et al., 1986). Thus, the pursuit of material security persists even in the presence of intellectual acceptance of life’s uncertainty.

5. MORAL CONFLICT AND LEGAL RESPONSIBILITY

Legal systems are built on the assumption of rational and autonomous individuals capable of making informed choices. However, recognition of cognitive limitations and internal conflict challenges this assumption. Modern legal scholarship increasingly acknowledges the concept of bounded rationality, which recognises that human decision-making is influenced by cognitive biases and emotional factors (Sunstein, 2005).

This understanding does not eliminate legal responsibility but calls for a more nuanced approach to accountability. Laws that incorporate psychological realism are better suited to achieve justice, deterrence, and rehabilitation rather than relying solely on punitive measures.

6. INCONSISTENCY AS A NATURAL HUMAN CONDITION

From an evolutionary perspective, inconsistency is not a flaw but an adaptive feature. Charles Darwin recognised that emotional traits such as desire, fear, and competition played a significant role in human survival (The Descent of Man, 1871). While these traits may conflict with modern moral ideals, they remain deeply embedded in human biology.

Therefore, the inability to remain constant in belief or conduct does not necessarily indicate moral weakness or psychological abnormality. Instead, it reflects the complex interaction between biological instincts, social conditioning, and rational thought.

7. CONCLUSION

The internal conflict between belief and reason, knowledge and action, and morality and desire is an intrinsic aspect of human existence. The question “Is everything alright with me?” ultimately reflects a universal human condition rather than individual failure.

Recognising this complexity allows for a more realistic understanding of human behaviour within legal and moral frameworks. Rather than denying human inconsistency, law and society must account for it while maintaining standards of responsibility and accountability.

REFERENCES

Aristotle. Nicomachean Ethics. Darwin, C. (1871). The Descent of Man. London: John Murray. Festinger, L. (1957). A Theory of Cognitive Dissonance. Stanford University Press. Greenberg, J., Pyszczynski, T., & Solomon, S. (1986). The causes and consequences of a need for self-esteem. In Public Self and Private Self. Springer. Kahneman, D. (2011). Thinking, Fast and Slow. New York: Farrar, Straus and Giroux. Plato. The Republic. Sunstein, C. R. (2005). Laws of Fear: Beyond the Precautionary Principle. Cambridge University Press.

-

Abstract:

Public debates often focus on whether a minister must be formally educated to govern effectively. This question, though important, is incomplete. Constitutional democracy does not demand that authority flow only from academic credentials, nor does it presume that education alone produces responsible leadership. The deeper concern arises when both education and power drift away from their constitutional purpose. In a constitutional framework, power is not a privilege but a trust, while education functions as a means to cultivate constitutional values such as reasoned decision-making, equality, and accountability. When education is reduced to credentialism and power to command, public responsibility weakens. The Constitution privileges duties over degrees, demanding ethical restraint, transparency, and commitment to public welfare. The paper argues that legitimacy in governance flows not from formal qualifications or authority, but from the faithful discharge of constitutional responsibility toward society.

Keywords:

Education, Political Power, Constitutional Responsibility, Governance, Public Trust

Author:

Sidheswar Jena

PhD Scholar, Law

-

Education is commonly understood as the cultivation of reason, judgment, and intellectual autonomy. This reflection argues that when an educated individual relinquishes independent thought in favor of collective noise, education itself loses its meaning. Knowledge without critical engagement becomes passive conformity, and learning without reflection degenerates into mere credentialism. The crowd may offer comfort, validation, or power, but it cannot substitute for reasoned analysis and moral courage. True education demands the capacity to question dominant narratives, resist unexamined consensus, and think beyond popular approval. The erosion of independent thought among the educated not only weakens individual integrity but also undermines the social purpose of education as a force for progress, justice, and rational discourse. In this sense, education is diminished not by ignorance alone, but by the conscious surrender of intellectual independence.

-

The other evening, my 7-year-old son asked me a simple yet disarming question:

“Dad, when I grow up, will I live separately?”It took me a moment to respond. I smiled and asked him,

“Tell me, am I big or small?”

He replied, “You’re big, Dad.”So I asked,

“Then tell me, am I living separately or with whom?”

He thought for a moment and said,

“With Mom, Didi, and me.”I smiled again and said,

“Then how can you live separately, my son?”

He looked at me, paused, and said softly,

“Yes, you’re right, Dad.”That brief exchange stayed with me.

In that innocent question lay the truth of our times — that children today are growing up in a world where separation feels normal, and togetherness feels temporary.We have built societies so nuclear that the idea of living as one family seems like a memory of the past.

And yet, in that small conversation, I found hope — a reminder that the values of love, connection, and family still live in the purest corners of a child’s heart.Let’s not let those values fade.

Sometimes, the deepest lessons come not from books or laws, but from the innocent questions of our children.— Sidheswar Jena

PhD Scholar – Law

-

By Sidheswar Jena, PhD Scholar (Law)

Introduction

The Goods and Services Tax (GST) regime was designed to simplify taxation, but its penalty provisions have sometimes been applied in ways that burden honest taxpayers. A recurring controversy is whether the general penalty under Section 125 of the CGST Act can be imposed in addition to the late fee under Section 47 for delayed return filing. Several recent judicial pronouncements — notably from the Madras High Court — make it clear that such double penalisation is legally unsustainable.

—

Statutory Scheme: Section 47 vs. Section 125

Section 47 (Late Fee): imposes a fixed late fee for failure to furnish returns within time. It is a specific sanction tailored for delay.

Section 125 (General Penalty): provides a residuary penalty of up to ₹25,000, but only “where no penalty is separately provided for such contravention.”

The legislative intent is clear: if a contravention already attracts a specific fee or penalty under the Act, Section 125 cannot be invoked to duplicate punishment.

—

Case Law: Madras High Court’s Clarification

In Tvl. Jainsons Castors & Industrial Products v. Superintendent of GST (2025), the Madras High Court quashed a Section 125 penalty levied in addition to the late fee under Section 47. The Court held:

1. Section 125 is residuary and cannot be mechanically applied where a specific penal provision exists.

2. Imposing both late fee and general penalty amounts to double jeopardy in taxation, which is impermissible.

3. Absence of fraudulent intent or evasion makes the imposition of an additional penalty disproportionate.

The Court’s ruling aligns with earlier practitioner commentary and guidance notes that emphasise the limited role of Section 125.

—

Principle of Proportionality and Harassment Concerns

Penalties are punitive, not compensatory. The doctrine of proportionality requires that sanctions correspond to the nature of the offence. When a taxpayer has already discharged the statutory late fee, layering an additional penalty is excessive and amounts to harassment.

Courts have consistently discouraged such administrative overreach, underscoring that tax compliance thrives on fairness and predictability — not fear.

—

Practical Implications for Taxpayers

If confronted with a Section 125 penalty for late filing:

Primary Defence: Section 47 already prescribes the sanction; Section 125 is inapplicable.

Secondary Defence: No intent to evade, taxes duly paid, delay was procedural.

Procedural Defence: Challenge lack of proper show-cause notice or hearing.

Relief can be sought through writ petitions, appeals, or representation to higher authorities citing the Madras HC decision.

—

Conclusion

The GST framework recognises that not all contraventions merit the same degree of punishment. Section 47 provides a specific and sufficient consequence for late filing — the late fee. Extending Section 125 to such cases is contrary to legislative intent, violates principles of fairness, and amounts to taxpayer harassment. Judicial guidance now reaffirms that officers must exercise discretion lawfully and avoid the temptation to “double punish.

The message is simple: no double penalty where the law already speaks once.

-

By: Sidheswar Jena

PhD Scholar – LawEDUCATION IS FREEDOM, EDUCATION IS LIFELINE

Education is more than classrooms and textbooks—it is the heartbeat of a society. It shapes individuals, defines values, and determines whether a nation rises or collapses. Without education, a society does not just stand still; it slowly disintegrates.

Education is freedom. Education is lifeline. It liberates minds from ignorance, empowers people to question injustice, and ensures that societies remain alive and progressive.

WHY A SOCIETY CANNOT SURVIVE WITHOUT EDUCATION

Education is the foundation of progress. It builds informed citizens, skilled workers, responsible leaders, and ethical thinkers. A society that ignores education breeds ignorance, inequality, and chaos. From technology to healthcare, from democracy to economy—every system collapses in the absence of educated citizens.

➡️ In short, NO EDUCATION MEANS NO DIRECTION.

THE POWER OF QUALITY EDUCATION

But not just any education will do. QUALITY EDUCATION is what makes the real difference.

It encourages innovation.

It sharpens critical thinking.

It empowers individuals to solve problems creatively.

Poor-quality education, on the other hand, creates blind followers instead of independent leaders. A society’s future is directly tied to the quality of education it provides today.

WHO FEARS EDUCATION?

It is not the poor who dislike education—it is the powerful who fear it. Dictators, corrupt leaders, and extremist groups see education as a threat. Why? Because educated people ask questions, resist propaganda, and refuse to be controlled.

📖 History shows us: every oppressive regime first attacks schools, teachers, and books.

WHY EDUCATION IS SO COSTLY

If education is so vital, why is it out of reach for so many?

The truth is, education has become commercialized. In many parts of the world, it is treated as a business, not a right.

Private institutions charge unchecked fees.

Government investment often remains inadequate.

Quality education becomes a privilege of the wealthy, leaving the poor behind.

COUNTRIES THAT PRIORITIZE EDUCATION

Some nations prove that when governments invest in education, societies thrive:

Finland: Stress-free, student-focused learning.

Singapore: Discipline, competitiveness, and global skills.

Germany: Free or affordable higher education, ensuring equal access.

Japan: Strong values of discipline and ethics built into schooling.

✅ These nations see education not as an expense, but as an investment in their future.

THE PROBLEM OF EDUCATION GOONS

In many countries, private schools and coaching centers exploit parents with sky-high fees.

But countries like Germany and Finland have strict rules to regulate costs, prevent exploitation, and maintain fairness. Strong governance ensures that education remains a right—not a luxury.

HITLER’S HATRED TOWARD EDUCATION

Adolf Hitler understood the power of free thought—and feared it.

He closed educational institutions.

He censored books.

He promoted Nazi ideology in schools to create obedient followers.

His example shows what happens when education is suppressed: societies become tools of tyranny.

MY TAKE: EDUCATION IS FREEDOM, EDUCATION IS LIFELINE

Education is not optional—it is the lifeline of a free and progressive society. Without it, there is no innovation, no democracy, and no justice.

Education is freedom. Education is lifeline.

Nations that empower education build leaders.

Nations that suppress it breed slaves.

The choice is clear: to survive and thrive, we must invest not just in education, but in QUALITY EDUCATION FOR ALL.

By: Sidheswar Jena

PhD Scholar – Law

-

By Sidheswar Jena

PhD Scholar – LawWe often hear people say society is “intelligent.” But if that is true, why does the crowd so easily follow someone who keeps lying—even when those lies are exposed in broad daylight? At the same time, a person who speaks truth clearly and directly is ignored, even abandoned. This contradiction is not just politics or culture—it is psychology.

Repeated Lies Feel Like Truth

Psychologists explain something called the illusory truth effect: when a lie is repeated many times, our brain starts to accept it as truth. Familiar words feel safer than unfamiliar facts. Lies are repeated loudly, again and again, while truth is usually quiet, serious, and said only once. Naturally, the crowd remembers the lie, not the fact.

The Pull of the Crowd

Another reason is herd mentality. Most people do not like to stand alone. If the majority believes in a lie, joining them feels safe, while supporting the truth feels risky and isolating. It is easier to move with the tide than against it.

Lies Are Attractive, Truth Is Heavy

Lies are often sweet. They promise quick fixes, easy answers, or someone to blame. Truth is harder—it demands responsibility, patience, and sometimes sacrifice. People turn away from truth not because they cannot see it, but because they do not want the burden that comes with it.

The Contradiction of “Intelligent Mass”

This creates a painful contradiction. Society, which prides itself on being educated and progressive, ends up rewarding liars while punishing truth-tellers. In reality, the “intelligent mass” often acts not with intelligence, but with fear, greed (lalach), and emotion.

Has Truth Lost Its Value?

Today, truth seems less about facts and more about agreement. If enough people believe a lie, it starts to look like reality. This is why a repeated liar can be celebrated, while an honest person is left alone.

The Hard Reality

The sad truth is this: lies survive because they are easy to hear, while truth is difficult to accept. Until society learns to choose truth over comfort, the liar will continue to be cheered in daylight, and the truth-teller will continue to stand in silence.

-

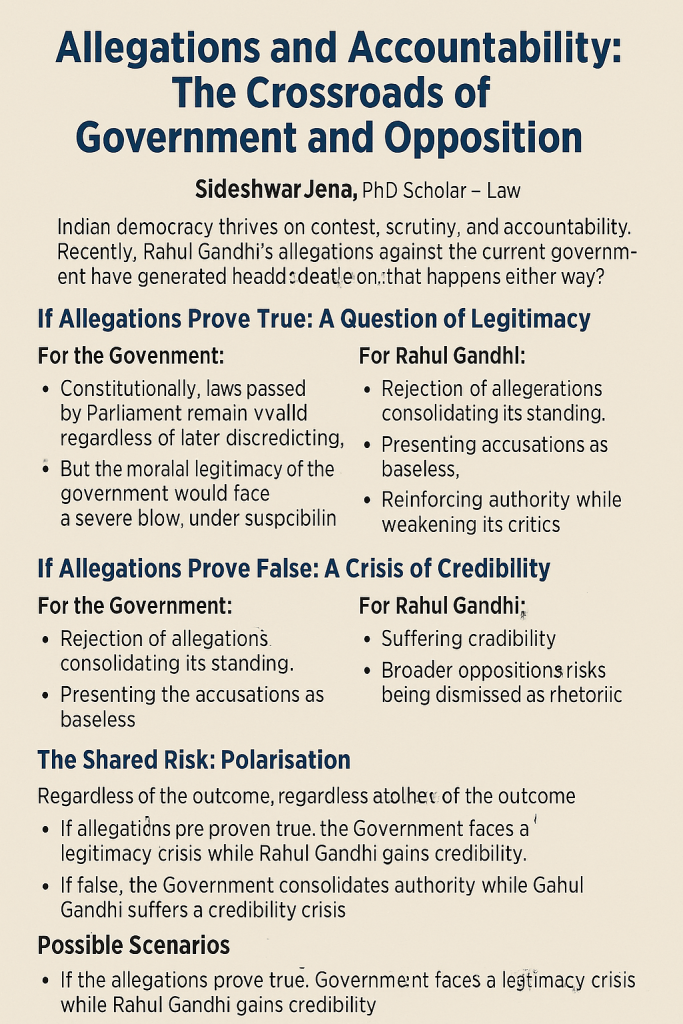

By Sidheswar Jena

PhD Scholar – LawIndian democracy thrives on contest, scrutiny, and accountability. At its core lies not only the power of governments to enact laws but also the responsibility of opposition leaders to question them. Recently, Rahul Gandhi’s allegations against the current government have generated heated debate. The real questions are: what happens if these allegations are proven true—or if they are proven false? And what if nothing happens either way? Who compensates the loss of public trust suffered by the common citizen?

I cannot comment on matters under the Election Commission of India’s jurisdiction, but one must ask: isn’t it the prime duty of the ECI to address such issues with seriousness rather than dismissive remarks? Allegations of this scale are not merely about politics—they strike at the integrity of the nation and the credibility of its institutions. Should the Supreme Court or even the President not consider taking suo motu cognisance, rather than allowing the issue to boil unchecked?

Why can’t we, as citizens, demand from both sides—government and opposition—fair justice, transparency, and responsibility?

If Allegations Prove True: A Question of Legitimacy

For the Government:

- Constitutionally, laws passed by Parliament remain valid regardless of later discrediting. They can only be repealed by Parliament or struck down by courts.

- But the moral legitimacy of the government would face a severe blow. Policies would be seen less as governance and more as actions under suspicion.

- Critics argue this could deepen political divisions, creating a climate of distrust and instability.

For Rahul Gandhi:

- Vindication would give him political capital and reinforce his narrative of accountability.

- The younger generation, often skeptical of politics, may begin to see him as a credible challenger.

- He would move from being a critic to a leader who stood vindicated against power.

If Allegations Prove False: A Crisis of Credibility

For the Government:

- Rejection of the allegations would consolidate its standing.

- The ruling party would present itself as vindicated, portraying the accusations as baseless.

- This would reinforce its authority while weakening its critics.

For Rahul Gandhi:

- His credibility would suffer.

- The electorate, particularly younger voters, may view him as raising charges without evidence.

- The broader opposition would also weaken, as future criticisms risk being dismissed as rhetoric.

The Shared Risk: Polarisation

Regardless of the outcome, polarisation remains the common danger. Allegations of this magnitude divide citizens along ideological lines, eroding faith in institutions and in each other. Whether the government emerges stronger or the opposition vindicated, democracy suffers if debates do not translate into transparency and accountability.

Here, responsibility lies with:

- The Election Commission of India – to uphold electoral credibility.

- The Supreme Court – to act when constitutional balance is at stake.

- The President of India – as the guardian of constitutional morality.

- The Common Citizen – to demand accountability without bias.

If these actors fail to respond responsibly, then India—one of the world’s strongest democracies—risks long-term damage. It will not just be today’s citizens but also our future generations who suffer.

The Larger Democratic Lesson

This moment reflects a deeper truth: both government and opposition bear responsibility.

- Governments must ensure transparency to prevent suspicion.

- Opposition leaders must back challenges with substance, so credibility is not lost in overreach.

Ultimately, democracy depends less on who wins a political battle and more on whether public trust survives the contest.

Possible Scenarios

- If the allegations prove true: The Government faces a legitimacy crisis while Rahul Gandhi gains credibility.

- If false: The Government consolidates authority while Rahul Gandhi suffers a credibility crisis.

- If undecided: The citizens are the real losers—left with doubts but no answers.

Either way, India’s true test lies in rising above polarisation and ensuring that accountability—on both sides—remains the foundation of its democratic spirit.

-

By Sidheswar Jena- PhD Scholar-Law

Introduction

On March 24, 2021, the Ministry of Corporate Affairs (MCA) issued Notification No. G.S.R. 205(E) introducing the Companies (Accounts) Amendment Rules, 2021. These rules made it compulsory for companies to maintain accounting software with an audit trail (edit log) feature. The intent was clear: stop backdated manipulation, ensure every change is logged with a timestamp, and make auditors accountable for reporting compliance.

After two years of deferment, the requirement finally came into force from April 1, 2023 for the financial year 2023–24. This was hailed as a milestone for corporate governance and financial transparency. But the real question remains: Has this mandate delivered any real benefits, or is it simply another costly compliance burden?

Under the amended rules, companies must ensure that:

- Their accounting software has a non-disableable audit trail/edit log.

- Every transaction and subsequent change is recorded with date and user details.

- Audit logs are preserved as per record-retention norms.

- Auditors, under Rule 11(g), report on whether:

- The company used audit-trail-enabled software.

- It remained operational throughout the year.

- It was tamper-proof.

- The records were properly preserved.

Promised Benefits of Audit Trails

- Transparency – A clear, verifiable record of all entries and changes.

- Forensic Use – Stronger tools for SFIO, SEBI, or tax authorities to trace misconduct.

- Deterrence – Making it harder for companies to manipulate books without leaving evidence.

- Investor Confidence – Reinforcing the trustworthiness of corporate disclosures.

The Reality After Mandate

- Fictional Transactions Remain

If the underlying data (invoice, receipt, adjustment) is false, the audit trail only preserves a well-documented fiction. Fraudulent inputs create fraudulent logs. - Compliance Costs Are Heavy

- Technology upgrades: Companies upgraded to compliant ERPs.

- Operational effort: Employees must maintain logs meticulously.

- Audit fees: Auditors charge more for verifying audit trail compliance.

For many SMEs, this feels like paying extra for more accounting work without obvious value.

- No Documented Public Wins Yet

Despite the mandate, no high-profile case has been publicly reported where audit trail evidence was decisive in uncovering fraud. Investigative agencies may already be leveraging logs, but the successes are not credited or highlighted in public domain.

Where Government Could Benefit

Even though results are not yet visible, audit trails can strengthen governance in key ways:

- Regulatory Oversight – MCA and SEBI can demand verifiable logs to check tampering.

- Tax Enforcement – Discrepancies between declared tax returns and company books could be traced back to edits.

- Forensic Investigations – Agencies like SFIO or ED could prove misconduct by showing who changed what, and when.

- Investor Protection – For listed firms, non-tamperable trails increase investor trust.

- Internal Governance – Companies can prevent small-scale frauds like duplicate invoicing or unauthorized payments.

The Illusion of Control

The biggest risk is that audit trails become a box-ticking exercise:

- If regulators check only for existence of logs, not substance.

- If auditors issue certificates without deeper verification.

- If management overrides systems or colludes internally.

In such cases, audit trails create an illusion of transparency—adding cost but not accountability.

My Take:

The audit trail mandate is an important step towards digital transparency. But as of now, it remains more of a burden than a boon for many companies. The government and regulators have not yet demonstrated measurable benefits, such as fraud prevention, improved enforcement, or cost savings to the public. For audit trails to achieve their potential, they must move beyond software compliance. Regulators must actively use them in enforcement, auditors must apply rigorous verification, and companies must embrace them as governance tools rather than obligations. Only then can the audit trail evolve from a costly ritual into a meaningful safeguard of accountability